Dutch Renewable Energy Group and economists call for indebted countries to grant land concessions to renewables investors.

The proposals would see the granting of development access to land by the Irish, Portuguese and Greek governments in exchange for credits which can be used to pay off part of their national debts.

While the group does mention the possibility of smaller scale diversely distributed renewables projects, their emphasis appears to be on larger scale projects.

The ECI, pointing to the a difference in onshore and offshore opportunities, suggested that the proposals demonstrate the potential benefits to Ireland of the renewables sector ‘should the correct balance of local ownership and the equal sharing of benefits for locals and the investors be achieved’.

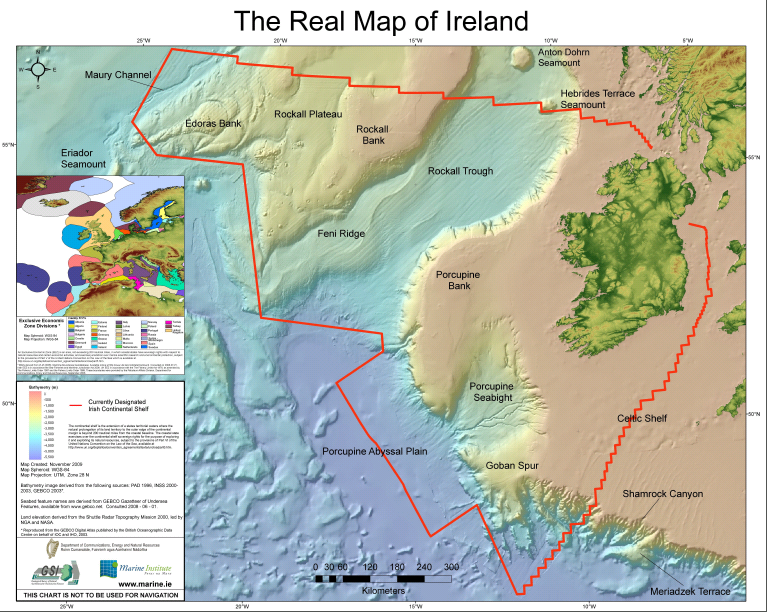

The proposals from Nederland Krijgt Nieuwe Energie appear to be a variation on the licensing arrangements that currently exist for energy exploration companies, in that the States involved would grant access to the land in exchange for up front credit. The amounts of land – and thus natural resources involved- would be quite substantial: in the case of Ireland and Portugal approximately 1% of the State’s land and in the case of Greece, 2%. This would be in exchange for sums equivalent to 30% of National debts.

‘A 30% debt reduction should be possible – assuming a 2.5% average yearly inflation, a modest 1.5 Eurocent profit per kWh in the 2020-2045 period and a conservatively estimated yield of 70 Gigawatt hour per square kilometer per year. Having a 40 billion Euro debt, Ireland ought to give 550 square kilometer into concession. This is less than one percent of Ireland’s total surface.’

While the juxtaposition of 30% of debt to a mere 1% of land seems like very favourable terms, we should bear in mind that the Corine survey of land use in Ireland in 2006 showed that ‘artificial fabric’ (all Ireland’s buildings, roads, etc) covered only 2.8% of the area of the country. Water-bodies (that’s lakes etc) covered 2.3% of the country. Thus 1% of Irish land equates to almost half the total area taken up by lakes or one third of the land that’s been built upon (obviously that’s not including the green-spaces between the buildings and roads).

Thus 1% of land may be quite considerable in this context.

However, when you look at the amount of offshore land that is available for wind generation use, that 1% seems much more achievable. Indeed Minister Rabbitte seemed to suggest in an interview with Bloomberg that he is looking at the possibility of partnerships with bigger corporate investors , including leasing offshore sites to investors who will supply the energy requirements of the UK. This is in the context of the increased interconnection of Irish and UK grids now presenting Ireland with opportunities to greatly increase wind generation.

This may see international investors being involved in very large offshore generation schemes with greater national and local involvement in onshore projects.

A spokesperson from ECI responded cautiously to the NKNE suggestions by saying: ‘The renewables sector in Ireland has the potential to be the engine of our economic recovery. With good interconnection, we can sell three to four times our national capacity of wind generation alone. Conservatively, that’s a potential 4 to 5GW market. We believe that the benefits of that recovery should be widely distributed. That means, not only that the renewables projects should be in a range of sizes, technologies and locations, but that they should be owned by as broad a range of shareholders as possible. That is: local co-op members and medium to large partner investors: from local business people to semi states, from Irish pension funds to large financial institutions.’

A longer term approach to economic recovery which maximizes the retention of profits within Ireland may in fact be more beneficial. There are highly valuable natural renewable resources in Ireland. There is a pre-disposition in many communities for the development of those resources for the benefit of the local communities. There is a viable means by which investment can flow into Ireland to develop those energy resources through partnership arrangements with corporate investors and the efficient distribution of Commission grant funding.

There are also highly promising internal sources of investment: co-operative revenue –raising schemes, the freeing up of moribund property investments, improved pensions investment opportunities in green energy through government incentive schemes, as well as State led capital schemes (including that for large scale schemes like Spirit of Ireland) on government to government level or through semi-state companies. This international market requires increased interconnection but is highly promising bearing in mind known international demand – it is in this area that multi-lateral and corporate partners in large-scale offshore projects make the most sense.

It may be that these schemes would provide equally good returns for their investors, but with greater secondary benefits, and greater returns for the exchequer. It is certain that for onshore proposals, the many benefits of projects originating within as well as situated in local communities will be easier to explain to those local groups than licensing arrangements with external corporations.